Hyperscale data center building boom to continue: Synergy Research Group

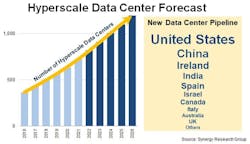

Synergy Research Group says it knows of 314 hyperscale data centers currently slated to be built worldwide – and expects more to be revealed in the coming years. This surge in construction bodes well for companies that rely on data center operator capex for revenues, the market research firm notes.

The addition of the 314 facilities will bring the total number of operational data centers beyond 1000 in the next three years, Synergy estimates (see chart above), with many more to come. The U.S. will continue to claim the largest share of such facilities; 40% of current operational hyperscale data centers are found in the U.S. (accounting for half of worldwide capacity) and the country has the largest numbers of upcoming data centers in the pipeline. China, Ireland, India, Spain, Israel, Canada, Italy, Australia, and the UK also should see new facilities during the forecast period. Between these new facilities and upgrades of existing sites, the average data center capacity will grow as well, the market research firm believes.

Synergy bases its estimates on the data center footprint and plans of 19 of the world’s major cloud and internet service firms, including the largest operators in IaaS, PaaS, SaaS, search, social networking, e-commerce and gaming. Cloud providers such as Amazon, Microsoft, Google, and IBM currently own the broadest data center footprint; each has 60 or more data center locations with at least three in each of the four major regions (North America, APAC, EMEA, and Latin America). Oracle, Alibaba and Tencent also have a notably broad data center presence. Amazon, Microsoft, Google and Facebook lead in terms of data center capacity, but Chinese hyperscalers, most notably ByteDance, Alibaba, and Tencent, are expanding their footprints more rapidly.

“The future looks bright for hyperscale operators, with double-digit annual growth in total revenues supported in large part by cloud revenues that will be growing in the 20-30% per year range. This in turn will drive strong growth in capex generally and in data center spending specifically,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “While we see the geographic distribution, build-versus-lease distribution, average data center size and spending mix by data center component all continuing to evolve, we predict continued rapid growth throughout the hyperscale data center ecosystem. Companies who can successfully target that ecosystem with their product offerings have plenty of reasons for optimism.”

Synergy’s Hyperscale Market Tracker research service provides data and metrics on 19 companies that meet Synergy’s hyperscale definition. The data includes information on the hyperscale data center footprint, a full data center listing, analysis of critical IT load, future data center pipeline, hyperscale operator capex, hyperscale data center spending, company revenues, and five-year forecasts.

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.

Stephen Hardy | Editorial Director and Associate Publisher, Lightwave

Stephen Hardy is editorial director and associate publisher of Lightwave and Broadband Technology Report, part of the Lighting & Technology Group at Endeavor Business Media. Stephen is responsible for establishing and executing editorial strategy across the both brands’ websites, email newsletters, events, and other information products. He has covered the fiber-optics space for more than 20 years, and communications and technology for more than 35 years. During his tenure, Lightwave has received awards from Folio: and the American Society of Business Press Editors (ASBPE) for editorial excellence. Prior to joining Lightwave in 1997, Stephen worked for Telecommunications magazine and the Journal of Electronic Defense.

Stephen has moderated panels at numerous events, including the Optica Executive Forum, ECOC, and SCTE Cable-Tec Expo. He also is program director for the Lightwave Innovation Reviews and the Diamond Technology Reviews.

He has written numerous articles in all aspects of optical communications and fiber-optic networks, including fiber to the home (FTTH), PON, optical components, DWDM, fiber cables, packet optical transport, optical transceivers, lasers, fiber optic testing, and more.

You can connect with Stephen on LinkedIn as well as Twitter.