Critical considerations for a fiber deployment strategy

If money was no object, and time was not a factor, regional service providers would use fiber for every broadband connection. But each serving area has different requirements and presents a different set of challenges that affect the economics associated with delivering ultra-broadband. The key to an effective business case is a fiber to the most economical point (FTT$) strategy that uses the right mix of fiber and other technologies to create the ideal balance between capital expenditures (CAPEX), operational expenditures and (OPEX), and time-to-market requirements.

Analyze capital expenditures

As you move towards an ultra-broadband strategy, consider the density of households in a serving area, the broadband speeds that are needed to meet subscriber expectations, and the time needed to provide new services. Based on these considerations, an end-to-end fiber deployment may not be the right solution for every serving area. In some cases, the business case for fiber all the way to the business or home will make sense. In others, fiber can be deployed close enough that you can then leverage other access technologies, such as a copper or cable local loop, or a wireless technology.

But how do you determine which combination of technologies will provide the ideal balance between performance, time-to-deployment and cost?

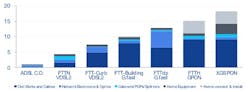

Nokia Bell Labs has developed a CAPEX model that offers insights into the costs associated with different access technology options, including Gigabit passive optical network (GPoN), G.fast, and VDSL2. This model is based on years of consultation with large and small service providers and it points to the CAPEX spend per subscriber for a variety of deployment models on a relative cost scale (Figure 1). The models provide a high level view for consideration and actual costs will vary widely depending upon the unique challenges faced by each operator’s network deployment.

Figure 1. CAPEX comparison of various access technologies at different subscriber densities

Based on the assumption that all homes and businesses have an existing copper twisted pair connection, Nokia Bell Labs uses Asymmetric Digital Subscriber Line (ADSL) from the central office with no fiber investment as a cost baseline. All other technologies are then compared to that baseline.

The model shows that the costliest aspect of any deployment are the civil works to lay the fiber. Home equipment and installation also represent a significant factor for fiber connections.

Consider population density

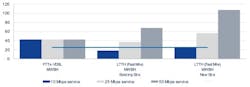

The Nokia Bell Labs model also shows the impact of subscriber density on CAPEX (Figure 2). As density falls, CAPEX per subscriber rises, illustrating the challenges of serving low density rural areas. Here the compromise between speed and cost is clearly shown with the gray line adding perspective by indicating the cost of deploying FTTH in an urban area. and highlighting the need for a FTT$ business case that leverages multiple technologies to optimize capital costs and deliver ubiquitous ultra-broadband.

Figure 2. Rural relative cost per subscriber (10 HH/km2)

Evaluate operational expenditures

Of course, any effective business case must also be based on an analysis of projected operational expenditures. A FTT$ strategy offers significant OPEX advantages because it leverages all the benefits of fiber.

Fiber networks offer the lowest operational costs of any access technology. This is because passive optical network (PON) architectures use all-passive outside plant components, which have very low maintenance requirements. Plus, the Optical Line Terminal (OLT) access node located in the central office shares each fiber connection over a number of subscribers and consumes very little power compared to other technologies.

Optimize time-to-market

Ultimately, your business case for a FTT$ deployment will succeed or fail on how quickly you can meet subscriber expectations for service delivery. If you can’t meet subscriber demand for broadband service your competition will step in to fill the void.

With a FTT$ strategy, you can bring fiber as close as economically possible to the subscriber and leverage the most appropriate technology to make the final connection. This will allow you to leverage all the benefits of fiber and deliver competitive ultra-broadband services today, rather than delaying deployment for some time in the future when an end-to-end fiber network is more cost-effective. More importantly, your subscribers will get the services they demand and will be less likely to look around for other options.

An FTT$ strategy also addresses the fact that no network can be built overnight. Therefore, a deployment strategy that leverages other technologies to meet demand makes the most business sense. It enables you to connect difficult to reach areas with fixed-wireless or FTTx to deliver broadband speeds. This secures your subscriber base, immediately increases average revenue per user (ARPU), and enables you to finance upgrades to fiber at a later date.

Partner with the right vendor

Operational strengths, existing infrastructure, market objectives, competitive environment and subscriber demographics, must all be considered to build the business case for a fiber deployment strategy. To enable an integrated approach for any deployment, work with a vendor who can provide and support the full-breadth of fiber, copper, cable and mobile ultra-broadband technologies. Nokia, for example, is the world leader in VDSL2 vectoring and G.fast, the only GPON vendor with a top 3 market position in every region of the globe, a leader in 4G and 5G wireless technology, and the only trusted partner of both tier 1 service providers and countless municipal, rural and regional operators.

For more information about how fiber can be combined with other technologies to provide the right balance for your business case, sign up for the Nokia FTTx webinar at https://goo.gl/m9hH9H