OS components: desperately seeking opportunities

Big bucks are not just around the corner for most component and subsystem vendors.

BY LAWRENCE GASMANOptical switching has long been touted as the missing link in the evolution of the all-optical network. But while a year or two back some analysts were predicting booming sales of all-optical-switching components and subsystems, an analysis of the underlying demand for these products recently published by Communications Industry Researchers, Inc. (CIR) predicts that the entire worldwide market for optical-switching components and subsystems will be valued at $258 million this year and increase to $532 million by 2006.

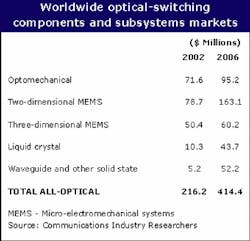

In fact, even these numbers might be considered by some to be overstated since they include conventional electronic-switching products used for optical-electrical-optical (OEO) switching equipment. According to CIR, worldwide shipments of all-optical switching devices-comprising those based on optomechanical, micro-electromechanical systems (MEMS), liquid-crystal (LC), and solid-state/waveguide technology-will rise from $216 million in 2002 to just $414 million in 2006 (see Table). Paradoxically then, the fastest-growing opportunity for optical-switching components and subsystems will be for electronic-switching devices for the core of OEO switching systems. The market for such devices will reach $118 million by 2006.

Fragmented market

The all-optical components and subsystems market is still sizable, of course, but the optical-switching components industry is highly fragmented. That restricts the opportunities. A company focused on high-port-count MEMS switching subsystems aimed at the long-haul optical crossconnects (OXCs) is a long way from being able to exploit opportunities such as protection switching that are best suited to, say, a low-port-count indium phosphide switching chip. In fact, with the leading MEMS subsystem manufacturer, OMM, dropping out of the three-dimensional (3-D) MEMS business-closely followed by rival Onix Microsystems-the optical-switching business has become even more fragmented, with a sharper line now drawn between a two-dimensional (2-D) MEMS sector and 3-D MEMS sector.

In CIR's view, this impression is being enhanced by the fact that some optical-switching subsystems vendors are now talking openly about the opportunities that they have as the result of the emergence of automated patch panels and a new breed of protection and restoration box for the network. CIR did not take revenues from these applications into account in its forecasts, partly because we think they are a long way from being realized in any significant way.

It is unfortunate that optical-switching component and subsystems manufacturers are beginning to focus so much attention on new-product areas, because there are some more credible opportunities from which they can grow their business:

- While OMM and Onix have pulled out of the 3-D MEMS business, most of the activity for all-optical-crossconnect cores involves 3-D MEMS, and sales of 3-D MEMS subsystems for this application are likely to reach $49 million by 2006 from $46 million now. We expect the entire 3-D MEMS market to expand to $60 million by 2006; we also believe that this size market could support no more than four profitable players and perhaps as few as two. Corning seems well placed to be one of these players.

- The 2-D MEMS companies appear to be ceding much of the large OXC business to 3-D MEMS. Nonetheless, we still expect the 2-D MEMS business to see opportunities, especially from the reconfigurable optical-add/drop-multiplexer and protection and restoration markets. The 2-D MEMS market will grow to $163 million by 2006, approximately doubling in size. As with 3-D, there are probably not enough revenues in the 2-D sector to keep many manufacturers in business. But with its established position in the 2-D business, OMM must be figured among the likely survivors.

- LC technology has been attracting a great deal of attention recently because of its performance features. CIR's forecasts have LC switching devices expanding to $43.7 million in 2006. However, this relatively small market size is counterbalanced by the fact that companies manufacturing LC switching components are also likely to be manufacturing other LC products, so sales of switching devices are likely to be just one revenue stream for such companies. (In contrast, MEMS switching device companies tend not to offer other kinds of MEMS products.)

- The promise of integrated optics based on waveguides and solid-state photonics remains unfulfilled, and switching devices are not the main focus of most integrated optics companies right now. But we believe revenues from solid-state/waveguide switches to grow as large as $52.2 million in 2006, with the prospects of integrated optics devices incorporating switching functionality ramping up quite quickly after that.

None of the opportunities outlined above are huge. But all of them will offer substantial revenue streams to companies that have positioned themselves correctly and listen carefully to what their customers are asking of them in terms of performance. And in an era of lowered expectations, what more can we reasonably expect?