Hyperscale data center operators such as Alibaba, Amazon, Facebook, Google, and Microsoft have embraced 100 Gigabit Ethernet (100GbE) for their data center networks. However, several of these companies have indicated that they require even higher transmission rates – both for intra- and inter-data center communications – in the near term. While some will adopt 200-Gbps technology, others plan to go straight to 400GbE. And with the necessary optical transceivers finally arriving on the market, this year just might be the dawn of the 400G era – although just barely and only if module availability intersects correctly with network operator plans, say analysts.

400GbE for inside the data center

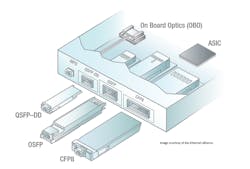

Data center network operators who don’t want to design their own modules (and there already are some who do) will have two types of 400-Gbps modules to evaluate for their requirements: PAM4-based transceivers that conform to IEEE 802.3bs specifications and coherent-enabled 400ZR devices built to the relevant OIF Implementation Agreement. The former likely will see its greatest use inside the data center, with the latter finding a home in data center interconnect (DCI) applications – at least to start.

IEEE 802.3bs offers a wide range of specifications for different Ethernet network requirements:

- 400GBASE-SR16, which covers at least 100 m over multimode fiber via 16 transmit and another 16 receive fibers, each transmitting at 25 Gbps (a study group has formed to investigate whether OM5 fiber and shortwave WDM technology could lessen the number of fibers required)

- 400GBASE-DR4, for at least 500 m over single-mode fiber using four parallel fibers in each direction with 100-Gbps transmission on each fiber; the decision to target 100-Gbps transmission was the subject of spirited debate

- 400GBASE-FR8, which uses eight-wavelength WDM to treat reaches of at least 2 km over a single-mode fiber in each direction

- 400GBASE-LR8, which is similar with -FR8 except the reach is extended to at least 10 km over single-mode fiber.

Proprietary variants of these specifications have already been announced. For example, Finisar (now part of II-VI) demonstrated an extended reach version of the LR8 (dubbed eLR8) at ECOC 2018.

And at least some of those deployments have begun, although not necessarily smoothly. According to LightCounting, Amazon began deployments of DR4 modules (good for 4x100GbE breakout applications) last year but slowed the initiative due to performance problems with the modules’ PAM4 DSP. Meanwhile, Google rolled out custom 2x200GbE devices last year as well, the market research firm said.

However, Dale Murray, a LightCounting analyst, indicated in a recent email exchange that he’s not expecting a huge ramp for standard 400GbE modules this year. “None of the largest data center operators are broadly deploying 400GbE as point-to-point 400GbE MACs communicating via optical modules,” he wrote. “The limitations of the 8x50-Gbps module electrical interface translates into a small switch radix; just 32 for a Tomahawk 3. The Tomahawk 4 is announced but will take some time to see deployment in 64-port switches. It will take a 100-Gbps SerDes ecosystem to cause a broad ramp of 400GbE and that’s not likely before 2022.”

That said, the deployments at Amazon and Google should continue this year, Murray believes. For example, LightCounting expects what Murray termed “healthy volumes” of DR4 shipments beginning in the second half of 2020. Meanwhile, he expects Google’s use of 2x200GbE devices to triple this year.

Andrew Schmitt, founder and directing analyst at Cignal AI, is in general agreement with Murray. “I think you’re going to see more people moving into production with DR4 and FR4 400GbE modules, and they’ll be single-wavelength 100G stuff. The single-wavelength 100G is probably more interesting, in terms of the immediate applications,” he told Lightwave. “The problem is that the hyperscale guys have all deviated to 200G or 2x200G types of solutions that allowed them to leverage cheap 100G optics and PAM4 chips and get better performance per dollar than going to the 400G solutions that were being proposed. So, all in all, there’s not a lot of interest from any of the hyperscale guys in standard 400GbE optics in 2020.”

That said, there may be some hope for standard 400GbE data center modules in 2020. “The only exception may be Amazon. I think they may be waiting for Intel to go to production with the DR4, and that’s a possibility,” Schmitt allowed. “But Microsoft is actually gating their usage of 400GbE clients by the availability of 400ZR. So the data center interconnect is driving the decision on the client-side optics.”

400ZR for DCI

Microsoft may not have to wait long to make their client-side 400G decisions. Demonstrations of 400ZR devices are expected to generate significant buzz at OFC 2020. Such modules incorporate coherent transmission technology into data center friendly form factors at a price point that’s expected to prove tolerable for hyperscale operators (and others) for DCI. And, therefore, the resulting demand should translate quickly into sales; Andrew Schmitt, founder and analyst at Cignal AI, told attendees at an OIF meeting last year that shipments of 400ZR modules should reach 20,000 in less than a year, although applications other than data center networks would help drive such sales.

The timing of 400ZR module availability naturally will drive deployment timelines. Murray and Schmitt agree that if there is to be quick ramp of 400ZR deployments within the hyperscale community, Microsoft (the prime customer for Inphi’s original COLORZ transceiver to enable IP over DWDM architectures) will drive it. “Certainly, the 400ZR should be a no-brainer replacement for COLORZ, if it’s doing what it’s supposed to be doing,” Schmitt said. “So I’ve got to believe that Microsoft would want to make the switch as soon as possible. But they haven’t specifically said what they’re going to do.”

Thus, whether speaking about inter- or intra-data center applications, it appears that the plans of one or two hyperscale data center operators will determine whether this year will see 400G deployments begin to ramp. And those plans don’t yet appear confirmed.

About the Author

Stephen Hardy

Editorial Director and Associate Publisher, Lightwave

Stephen Hardy is editorial director and associate publisher of Lightwave and Broadband Technology Report, part of the Lighting & Technology Group at Endeavor Business Media. Stephen is responsible for establishing and executing editorial strategy across the both brands’ websites, email newsletters, events, and other information products. He has covered the fiber-optics space for more than 20 years, and communications and technology for more than 35 years. During his tenure, Lightwave has received awards from Folio: and the American Society of Business Press Editors (ASBPE) for editorial excellence. Prior to joining Lightwave in 1997, Stephen worked for Telecommunications magazine and the Journal of Electronic Defense.

Stephen has moderated panels at numerous events, including the Optica Executive Forum, ECOC, and SCTE Cable-Tec Expo. He also is program director for the Lightwave Innovation Reviews and the Diamond Technology Reviews.

He has written numerous articles in all aspects of optical communications and fiber-optic networks, including fiber to the home (FTTH), PON, optical components, DWDM, fiber cables, packet optical transport, optical transceivers, lasers, fiber optic testing, and more.

You can connect with Stephen on LinkedIn as well as Twitter.