LightCounting says the AI boom is driving networking equipment, component Q3 earnings growth

As the networking industry awaits a positive sign that growth in the telecom industry is coming, look no further than in the third quarter.

According to Light Counting, the initial third-quarter financial results are unsurprisingly driven by the growing AI trend.

“Early financial results for Q3 2024 suggest some stabilization in the broader market for networking equipment and components as the AI boom continued,” the research firm said.

Hyperscalers, telcos varying capital patterns

Capital spending amongst hyperscalers and traditional communications service providers (CSPs) varied during the third quarter.

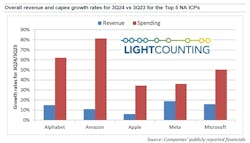

In the hyperscaler crowd, LightCounting noted that Alphabet, Amazon, Apple, Meta, and Microsoft spent “significantly more” this year than last, with combined spending rising 59% year-over-year during the third quarter.

“Most of these investments persistently go towards AI infrastructure: servers, data centers, and networking equipment which include optical connectivity as well,” the research firm said.

Traditional CSP spending continued to lag during the third quarter. Overall capex spending for the service providers dipped 3% versus the same period in 2023.

However, there were some exceptions. AT&T raised capex by 14%. Likewise, China Mobile’s capex was up 11% and NTT’s capex was up 3%.

LightCounting noted, "There is a good chance that the increases will continue in the last quarter of 2024 and extend into 2025.”

Mixed datacom results

Results were also mixed in the datacom and optical industry segments.

Ericsson and Nokia’s sales declined slightly by single digits. Despite the declines, LightCounting said the results reflected “a well-needed sign of stability.”

One of the standouts was Ribbon, which reported revenues rose 3.5% year over year. Ribbon’s growth was mainly due to growth in its Cloud & Edge secure communications business.

Datacom vendors reported mixed results during the quarter. Arista Networks reported $1.8 billion, up 20% from the third quarter of 2023. IBM reported revenue up 1% year-over-year, Juniper’s revenues dipped 5%, and Extreme Networks’ revenues were down 24%.

Optical players also showed growth patterns during the quarter with Coherent and Lumentum seeing gains.

Coherent reported that its networking segment revenue was up 12% sequentially and 61% year-over-year. Lumentum reported sales exceeding its guidance's upper end, increasing 6% year-over-year and 9% quarter-over-quarter.

Due to AI and data center demands, several Chinese optical module manufacturers saw quarterly and annual growth in the third quarter.

Innolight’s sales were up 115% year-over-year and up 11% sequentially. Eoptolink reported a year-over-year growth of 207% and a sequential growth of 49%.

Finally, data center-centric players, including AMD, Intel, and MACOM, also saw revenue boosts during the third quarter.

AMD’s Data Center segment revenue reached a new record at $3.5 billion, up 122% year-over-year. Similarly, MACOM’s Data Center segment revenue rose 39% to $56 million.

While Intel’s overall company revenue declined 6%, the company’s DCAI group revenue was also up 9% year over year, at $3.35 billion.

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.

Sean Buckley

Sean is responsible for establishing and executing the editorial strategies of Lightwave and Broadband Technology Report across their websites, email newsletters, events, and other information products.