BCE’s proposed $3.65B Ziply Fiber deal accelerates its North American fiber growth strategy

BCE’s Bell Canada is moving to acquire Ziply Fiber, a Pacific Northwest-based broadband provider, for about $3.65 billion, bolstering its foothold in the growing U.S. fiber-to-the-home (FTTH) market.

The service provider said in prepared remarks that the Ziply purchase strengthens Bell's growth profile and strategic position by giving it a foothold in the large, underpenetrated U.S. fiber market while increasing its scale, diversifying its operating footprint, and unlocking significant growth opportunities.

"This acquisition marks a bold milestone in Bell's history as we lean into our fiber expertise and expand our reach beyond our Canadian borders, said Mirko Bibic, president and CEO of BCE and Bell Canada. “By bringing Bell and Ziply Fiber's exceptional talent together, we'll accelerate our growth while continuing to deliver significant value for our customers and shareholders."

Once the acquisition closes, Ziply Fiber will operate as a separate business unit and will continue to be headquartered in Kirkland, Washington.

Scaling fiber

A key focus of this deal is that it immediately enhances Bell Canada’s FTTH provider status.

According to the Fiber Broadband Association, Canadian fiber passings had grown 12% to 12.1 million as of the end of 2023. Fiber now passes over 11.2 million unique Canadian homes, and fiber uptake in Canada is estimated at 44.6% (including incumbent providers and CLEC providers utilizing fiber installed by others).

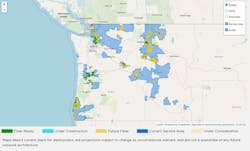

The Ziply acquisition extends Bell's fiber footprint to the United States, adding approximately 1.3 million fiber locations.

Also, the acquisition will reinforce Bell's position as the third-largest fiber Internet provider in North America, with a total of 9 million fiber locations and an objective to reach over 12 million fiber locations by the end of 2028.

Growing its fiber business is a clear objective for Bell Canada.

While it won’t release its third-quarter earnings until Thursday, November 7, during the second quarter, the service provider added 23,841 total new net retail Internet subscribers12, representing what it said was “our second-best Q2 result since 2007 after Q2 2023, reflecting continued strong demand for Bell's fiber services and bundled offerings with mobile service.”

It added that “this result was down 4.4% from 24,934 in Q2 2023, due to less new fiber footprint expansion than last year.”

Bell’s acquisition of Ziply will scale its fiber and overall broadband reach.

Ziply Fiber's focus on network technology and innovation has steadily expanded its footprint since 2020. With over 1.3 million fiber locations across four U.S. states, Ziply Fiber plans to reach more than three million locations in the next four years. Upon closing this acquisition, Bell will be poised to expand its fiber footprint to over 12 million locations across North America by the end of 2028, reinforcing its position as North America's third-largest fiber Internet provider.

Multi-element funding

BCE will fund the Ziply acquisition through various sources.

The company said the acquisition's purchase price is anticipated to be approximately $3.6 billion, $3.02 billion of which is expected to be funded from the net proceeds of its remaining 37.5% stake in Maple Leaf Sports and Entertainment (MLSE) to Rogers Communications.

BCE expects to fund the purchase price balance from a discounted treasury DRP program. Suppose the sale of BCE's ownership stake in MLSE closes after the close of this Acquisition. In that case, Bell entered a $3.7 billion fully committed delayed-draw term loan facility to finance the acquisition.

After closing the acquisition and completing its pending divestitures of Northwestel and BCE's ownership stake in MLSE, BCE's net debt leverage ratio is expected to remain relatively unchanged compared to its current ratio.

For related articles, visit the Broadband Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.

About the Author

Sean Buckley

Sean is responsible for establishing and executing the editorial strategy of Lightwave across its website, email newsletters, events, and other information products.