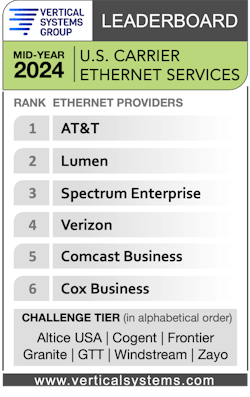

AT&T, through its aggressive fiber build into business buildings and size, remains the dominant Ethernet provider in the U.S. business services market.

The service provider once again topped Vertical System the U.S. Ethernet LEADERBOARD.

Joining AT&T on the top Ethernet provider list were again Lumen, Spectrum Enterprise, Verizon, Comcast Business, and Cox Business. According to VSG, network providers must have four percent (4%) or more of the U.S. retail Ethernet services market to qualify for a rank on the LEADERBOARD.

The research group noted that rank positions for the top six Ethernet LEADERBOARD providers in mid-2024 were unchanged from year-end 2023.

Service opportunities, challenges

From a service perspective, Ethernet poses new opportunities and challenges.

Service provider market shares on the LEADERBOARD are measured based on the number of billable retail customer ports installed. VSG’s Ethernet port share analysis includes six service segments based on what service providers are offering and enterprise customers are purchasing: Ethernet DIA (Dedicated Internet Access), E-Access to IP/MPLS VPN, Ethernet Private Lines, Ethernet Virtual Private Lines, Metro LAN, and WAN VPLS.

DIA (Dedicated Internet/Cloud Access) remains the largest and fastest-growing U.S. Carrier Ethernet service, based on revenue and ports.

However, VSG points out that challenges to Ethernet market growth include ongoing migration to other services, including Carrier Managed SD-WAN and SASE, Wavelength services, and Dark Fiber.

Lumen, for instance, contracted Corning to supply it with dark fiber infrastructure to target AI opportunities, leveraging the existing Level 3 conduit system to address emerging AI opportunities.

In August, the provider secured $5 billion in new business driven by a significant demand for connectivity fueled by AI. Lumen is also actively discussing with customers how to secure another $7 billion in sales opportunities to meet the increased customer demand.

Lumen said it will “more than double its intercity network miles over the next five years and provide access to a significant amount of installed dark fiber.”

Incumbent challenges, opportunities

While AT&T is the largest Ethernet provider and laid out a solid plan to transition to profitability in its enterprise services business, it continued to see challenges in the second quarter.

AT&T’s second-quarter Business Wireline revenues were down 9.9% year over year to $4.8 billion, primarily due to what it said was lower demand for legacy voice and data services and product simplification, partially offset by growth in connectivity services. Results also reflect the second-quarter 2024 contribution of its cybersecurity business to a new joint venture.

A crucial part of AT&T’s growth strategy for the Enterprise business is a two-pronged approach to expanding its 5G and fiber network to more markets, which would improve its position.

Pascal Desroches, AT&T's CFO, told investors during the Bank of America Media, Communications, and Entertainment Conference that the company's experience in developing complex network solutions has put it on a growth path for wireline and wireless-based business services.

“If you look inside enterprise business, there’s lots of things that are growing,” he said. “However, there are more dollars in legacy decline.”

Fellow Tier 1 providers Verizon and Lumen face similar legacy challenges.

Verizon Business’ second-quarter revenue was $7.3 billion in the second quarter of 2024, down 2.4 percent year over year. Increases in wireless service revenue were more than offset by decreases in wireline revenue.

Likewise, Lumen continued to see challenges in its business segment during the second quarter. While Lumen saw gains in the public sector side of its business segment, the service provider’s Business segment revenue dipped 11.4% to $2.57 billion.

“We expect the public sector to be the first channel to pivot to sustainable growth later this year. Followed by mid-market and then large enterprise,” said Chris Stansbury, CFO of Lumen. “Overall, North American business declined 5.5%. The Large enterprise revenue declined 6.9% in the second quarter.”

Cable’s continual gain

Cable operators continue to emerge as a growing force in the Ethernet and business services market overall.

Spectrum Enterprise, which retained its second position on VSG’s LEADERBOARD, saw gains across small and large enterprise customers during the second quarter.

The cable operator’s SMB customer relationships increased by 3,000 in the second quarter of 2024. Enterprise PSUs grew by 4,000 in the second quarter of 2024 versus 6,000 added in the second quarter of 2023.

Driven by enterprise and SMB revenue growth of 4.5% and 0.6% year-over-year, respectively, Spectrum Enterprise’s business segment grew 2.1% year-over-year to $1.8 billion. The cable MSO said that the year-over-year increase in the second quarter of 2024 SMB revenue was driven by higher monthly SMB revenue per SMB customer, primarily due to rate adjustments and customer relationship growth. Enterprise revenue, excluding wholesale, increased by 5.9% year-over-year, mainly reflecting PSU growth.

“SMB revenue grew by 0.6% year-over-year, reflecting SMB customer growth of 0.2% year-over-year and higher monthly SMB revenue per SMB customer, primarily due to rate adjustments,” said Jessica Fischer, CFO of Charter Communications. “Enterprise revenue grew 4.5% year-over-year, driven by Internet -- or enterprise PSU growth of 6.1% year-over-year.”

Comcast saw similar trends.

Business Services Connectivity revenue grew 5.7% in the second quarter to $2.4 billion. The company said this growth reflected steady growth in small businesses and even faster growth in mid-market and enterprise.

Jason Armstrong, Comcast's CFO, told investors during its second-quarter call that the company's strategy in the SMB market is to enhance relationships with customers via value-added services like security and Wi-Fi.

“While the SMB market remains competitive, we are competing aggressively by delivering best-in-class products and services and growing revenue through ARPU growth, driven by higher adoption of additional products that expand our relationship with our SMB customers, like mobile, SecurityEdge, Connection Pro and WiFi Pro, as well as through targeted rate opportunities,” he said.

Armstrong added that at the “mid-market and enterprise level, our revenue growth is primarily fueled by the increase in our customers, driven by the investments we have made in this space to build sales and fulfillment as well as expanding our capabilities in managed services, wide-area networking and cybersecurity.”

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.

About the Author

Sean Buckley

Sean is responsible for establishing and executing the editorial strategy of Lightwave across its website, email newsletters, events, and other information products.