Lumen maintains the top position in the wavelength services market

Lumen maintains its lead in the optical wavelength services market, reflecting its aggressive push to expand its fiber network to serve businesses and carriers.

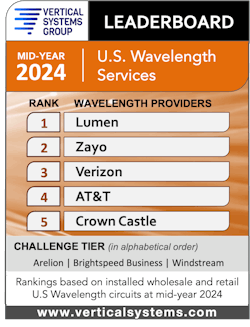

The service provider has once again topped Vertical Systems Group’s mid-year 2024 U.S. Wavelength Services LEADERBOARD.

Lumen was joined on the top five list in the optical wavelength market by Zayo, Verizon, AT&T, and Crown Castle. To qualify for a LEADERBOARD rank, companies must have four percent (4%) or more of the U.S. retail and wholesale wavelength services market.

Vertical Systems Group noted that the roster of companies on the mid-year 2024 U.S. Wavelength Services LEADERBOARD increased to five companies. Each company was ranked in order based on billable circuit share.

The research firm also saw movement among service providers on the Challenge Tier, including providers with a 1% and 4% share of the U.S. Wavelength market. Arelion (formerly Telia Carrier), Brightspeed, and Windstream attained a Challenge Tier citation on the mid-2024 U.S. Wavelength Services LEADERBOARD.

Rick Malone, principal of Vertical Systems Group, said wavelength revenue is on the rise due to AI demands.

“Wavelength revenue in the U.S. is on track to top $5 billion in 2024, driven by strong customer demand for retail gigabit circuits spurred by AI implementations,” he said.

Providers step up

Service providers in the top five groups continue to step up their efforts to enhance their fiber networks and offer higher-speed optical wavelength services.

Lumen, for one, told investors during its second-quarter earnings call that it is ramping up capacity on all segments of its fiber network.

Lumen Technologies has enhanced its position in the optical wavelength space by expanding its U.S. intercity dark fiber network, which will reach nearly 12 million fiber miles, creating diverse routes to more than 50 major cities nationwide. To differentiate its network, Lumen continues upgrading its infrastructure using a multi-con duit system, allowing for the quick deployment of new fiber technology.

It also built out its 400G wavelength network. The service provider has deployed its U.S. intercity wavelength network over 70 markets, giving customers diverse routing options. Over 240 data centers are enabled for 400G Lumen Wavelength Services, and over 800 Tbps of capacity currently runs across the network. Lumen is fulfilling customer orders of more than 50TB of 400G wavelengths.

“We are increasing connectivity both inside the metro areas as well as in the long-haul networks,” said Chris Stansbury, CFO of Lumen. “And that's with new routes and pulling more fiber on existing routes.”

He added, "each deal is a bit different, but when you overlay them all together, you see a doubling in metro and a significant increase in the long-haul network.”

Although AT&T and Verizon maintained a dominant spot in the business segment, they continued to see revenue challenges during the second quarter.

AT&T reported that Business Wireline revenues were down 9.9% year over year, primarily due to lower demand for legacy voice and data services and product simplification, partially offset by growth in connectivity services.

Likewise, Verizon reported that total revenue was $7.3 billion in the second quarter of 2024, a decrease of 2.4 percent year over year, as increases in wireless service revenue were more than offset by decreases in wireline revenue.

Crown Castle has been realigning its fiber solutions business, focusing on customers that reside on the path of its fiber network.

“We believe we can improve returns by focusing our sales efforts on on-net or near-net opportunities that reduce discretionary capital expenditures going forward,” said Steven Moskowitz, president and CEO of Crown Castle. “We've already adjusted our go-to-market commercial plan to support these changes.”

Rosemary Cochran, principal of Vertical Systems Group, said "Crown Castle has expanded its fiber portfolio through overall restructuring and better marketing."

She added, "The company moved up to the Mid-2024 U.S. Wavelength LEADERBOARD from the Challenge Tier based on circuit share, and they are also ranked eighth on the YE2023 U.S. Fiber Lit Buildings LEADERBOARD."

The AI factor

The growth of AI is a big factor driving the growth in the higher-speed optical wavelength market services.

VSG noted that the escalating surge of AI applications is a significant purchase driver for 100+ Gbps wavelengths.

The research firm said that 400G is also a factor. Customers purchasing 400 Gbps wavelength services include top hyperscalers, financial entities, data centers, media and entertainment companies, and cloud providers.

However, VSG added that U.S. fiber service providers cite low customer demand for 800 Gbps wavelength services.

“Based on our latest research, double-digit annual growth is projected for 100 Gbps and higher speed wavelength circuits through 2028,” Malone said.

Lumen’s Stansbury said Lumen is well prepared to support the upcoming demand for 400G and beyond speed wavelength services. “The fiber that we put in the ground already and adding today supports 400 gig waves. Over the next two years, that will scale to 800 and 1.6 terabytes,” he said.

For related articles, visit the Network Design Topic Center.

For more information on optical components and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of optical communications technology, subscribe to Lightwave’s Enabling Technologies Newsletter.

About the Author

Sean Buckley

Sean is responsible for establishing and executing the editorial strategy of Lightwave across its website, email newsletters, events, and other information products.