WDM-PON gains notice in the U.S.

During the Optoelectronics Industry Development Association’s (OIDA) Annual Forum, held late last year in Washington, DC, keynote speaker Mark Wegleitner, senior vice president and CTO of Verizon (New York), revealed that the carrier expects to migrate its fiber-to-the-premises (FTTP) network “from BPON to GPON to eventually become WDM-PON.” This statement is significant as it marks the first time Verizon, the FTTP leader in North America, has publicly positioned WDM-PON as a possible next step in the fiber access ladder.

There are few players in the nascent WDM-PON segment, but they are nevertheless making strides toward market acceptance. Korea Telecom is leading the charge on the carrier side, with field trials in 2004 and volume deployment in 2005. The carrier has deployed 50,000 lines to date with another 25,000 lines currently on order with startup Novera Optics (Palo Alto, CA), which has taken the lead on the vendor front.

Novera Optics sells its WDM-PON systems directly to Korea Telecom but also offers subsystems and modules, which it has sold to the likes of LG Electronics (Seoul, Korea). The vendor has begun talking to U.S. customers about the myriad benefits of WDM in the access network.

Bernd Hesse, vice president of marketing and business development with Novera Optics, believes that a passive optical network, in which fiber is shared among multiple end users, makes economic sense. “Sharing the fiber is not the issue,” he says, “but sharing the bandwidth is a huge issue.”

A BPON system, for example, supports 622 Mbits/sec downstream and 155 Mbits/sec upstream. If there are 32 subscribers on the system, that bandwidth is divided among the 32 subscribers-plus overhead. Upstream, a BPON system provides 3 to 5 Mbits/sec when fully loaded. “From our point of view, this is one of the major problems today with traditional PON networks,” says Hess. “You’ve limited your applications on the edge at the customer premises. Nobody can predict what [bandwidth] we will need tomorrow.”

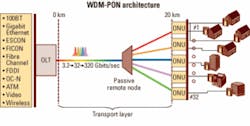

WDM-PON systems, by contrast, allocate a separate wavelength to each subscriber, enabling the delivery of 100 Mbits/sec or more of dedicated bandwidth per subscriber or optical network unit (ONU). Moreover, WDM-PONs are protocol and bit-rate independent, supporting the transmission of any service or service mix, including Gigabit Ethernet, ESCON, FICON, Fibre Channel, OC-N, ATM, and FDDI, at any bit rate (see Figure).

WDM-PON has a unique ability to support any future bandwidth upgrade without altering the physical infrastructure, which cannot be said for traditional TDM-PON architectures, says Hesse. He notes that the average lifecycles of TDM-PONs are growing shorter. “APON was around for almost 10 years with 155 Mbits,” he says. “Since 2000, it’s been developing fairly fast with BPON, EPON, and GPON. Verizon was completely behind BPON, but already they are looking into GPON,” he muses.WDM-PON networks also mitigate security concerns. With traditional TDM-PONs, every ONU receives the same signal, which has been split among the subscribers. To prevent a security breach, the signal must be encrypted. WDM-PONs provide virtual point-to-point connections between the subscriber and the central office, so information sharing is not an issue.

Finally, testing and troubleshooting is much easier with a WDM-PON system, says Hesse. An optical time-domain reflectometer (OTDR) typically is used to locate fiber breaks, but in traditional TDM-PONs, the OTDR cannot determine the amount of Raleigh backscattering beyond the power splitter. The OTDR pulse travels down 32 different paths, all of which experience backscattering; there is no way to find the exact fault location.

WDM-PON offers a diagnostic advantage, says Wayne Sorin, chief scientist at Novera Optics. “Because you have a separate wavelength going to each ONU, you can use a WDM OTDR or a wavelength-tunable OTDR from the central office to identify and characterize every fiber in the network all the way to the ONUs.”

In the past, a wavelength-specific or tunable distributed-feedback (DFB) laser was required at each ONU, adding to network cost and complexity. But Novera Optics now has developed identical, colorless lasers, rendering all ONUs identical while they operate at different wavelengths.

“We do this with injection-locking techniques where, from the [central office], we supply a broadband light source that is fed into the laser,” explains Sorin. “It’s like a seed signal or injection-locking signal that forces the laser to lase on that wavelength, making it look like a quasi-DFB laser even though it is a low-cost Fabry-Perot laser.”

Sorin also cites arrayed waveguide gratings (AWGs) or passive splitters as key enablers of WDM-PON technology, though Novera Optics relies on an outside vendor for this part of its system. Historically, AWGs operated only in controlled environments, but today’s devices are athermal or temperature independent. They also support bidirectional transmission from the same port, with one feeder fiber and one fiber from the remote node to the ONU, and one wavelength upstream and one downstream on the same fiber, says Sorin.

San Jose, CA-based NeoPhotonics has developed athermal AWGs based on planar lightwave circuits (PLCs) for WDM-PON, but it also supplies splitters for traditional TDM-PONs as well. “I would say the jury is out,” contends Ferris Lipscomb, NeoPhotonics’ vice president of marketing, when asked to assess WDM-PON’s long-term viability. “It’s not clear which one is going to win in the long run. I think regular PON-BPON, GPON, and GE-PON-will certainly win in the short run.” He adds, “The question now is whether that extra bandwidth [that WDM-PON systems provide] has any economic value.”

The folks at Novera Optics scoff at the idea that WDM-PON is too expensive, citing the lifecycle benefits of the technology. “WDM-PON is always less expensive because you can keep the infrastructure out there, eventually changing a leg of the PON to a higher bandwidth, a different service, and so on,” explains Hesse. “This is something that you cannot do with a traditional TDM-PON.”

For a low-bandwidth application, TDM-PON might be a little less expensive, admits Sorin, but as bandwidth demand increases, the economics change. “In terms of cost per bit rate,” he says, “we are more efficient and economical.”

All of which begs the question: Why are carriers like Verizon choosing a migration path to WDM-PON? Why not skip GPON entirely? According to Novera Optics, it’s all a matter of timing.

“We are a bit too late with entering the market and getting the technology in front of big carriers,” admits Hesse. “If we had been there two years ago when they started the discussion about GPON, I believe they probably would have gone with WDM technology.”

Prior to the last 12 to 18 months, tunable or colored lasers were required for the ONU, and AWGs had yet to be hardened for outside applications. The absence of a WDM-PON standard also gives many carriers pause. In a conference session last October, Ralph Ballart, vice president of broadband infrastructure and services at SBC Labs, admitted that AT&T is also interested in WDM-PON, though he noted that a standard is necessary.

Verizon spokesman Mark Marchand declined to comment on the company’s path to WDM-PON, noting only that Verizon “is taking the lead in this industry with fiber in the access network all the way to the home and the small/medium business.” He did confirm that the carrier will begin deploying GPON this year.

“We think the demands are just going to keep building for the type of speeds and capacities that GPON offers us. We’re moving ahead with that, and you’ll see us making some distinct moves in ’06. But as far as WDM, that’s a little further out,” Marchand admits.

Timing, not relevance, seems to be the issue with WDM-PON. “Right now, a few megabits, we wonder, ‘How will we ever use it up?’” muses Lipscomb. “But we know from the history of the technology that people will find a way to use it up, and they will always want more. So I think Verizon’s statement is probably correct,” he says. “Eventually, it will be something like WDM-PON. The real open question is, ‘What timeframe? When is eventually?’”Meghan Fuller is the senior news editor at Lightwave.