Real estate developers have found that fiber-to-the-home networks improve property values and attract residents.

Shane Shaneman

Corning Cable Systems

With PC penetration reaching an all-time high and over 1.2 million single-family homes being built each year (Source: eMarketer, 2002), many real estate and home developers have chosen to distinguish their properties by providing prospective residents with access to state-of-the-art, broadband infrastructure and enhanced services (e.g., security, monitoring, etc.). In their "quest for broadband," many developers have discovered that incumbent service providers are unable or unwilling to meet their needs. As a result, several developers are now working independently or hand-in-hand with competitive local exchange carriers to successfully deploy fiber-to-the-home (FTTH) networks throughout their developments.

For many developers, having an FTTH network in their development gives them an edge by providing a future-proofed infrastructure that offers residents (1) an enhanced quality of life for their families, (2) improved access to community resources (such as education and medical services), (3) the ability to leverage new broadband applications and services (e.g., streaming media, remote monitoring, online gaming), (4) increased productivity for home businesses and telecommuter applications (through virtual private networks or video conferencing), and (5) increased property valuations and higher home resale value.

FTTH is not a new networking technology; in fact, many such networks have been deployed over the last decade -- but primarily in niche markets. However, over the last two years there has been a marked increase in the number and breadth of medium to large residential developers (250 to 1,000 homes) deploying FTTH networks during the construction of their developments. In a recent review of FTTH networks deployed to date, almost half of the deployments are located in residential developments -- with a majority of these being deployed in the last two years (Source: Analysis performed by Render & Vanderslice for FTTH Council, 2002).

One example of this trend is the group of seven fully operational FTTH communities that Eagle Broadband, a broadband products and services provider from League City, TX, is currently building in the cities of Houston and Austin. Initiated more than two years ago, these exclusive residential communities have available a complete package of bundled digital services consisting of voice, video, high-speed data, and home security provided over an FTTH network being deployed throughout the neighborhoods as they are built.

Since FTTH is not necessarily a "new" network technology, what has changed over the last few years to result in such an increase in FTTH deployments?

FTTH drivers

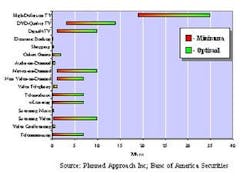

First and foremost, the demand for broadband applications and services continues to increase at an exponential rate -- fueled by the increasing penetration of the PC in the United States and the exponential growth in processor speeds over the last 5 years. Figure 1 depicts the minimum bandwidth requirements for various applications and services as well as the level of bandwidth that would offer optimal performance.

Second, broadband applications continue to evolve in sophistication, and new broadband services are being developed to leverage the increasing amount of bandwidth available to residential customers.

In 2001, broadband connectivity accounted for roughly 20 percent of the 45 million online households in the United States. Over the next three years, broadband penetration will continue to accelerate, resulting in a 45 percent share of the projected 77 million online households in 2004 (Source: Gartner Group, eMarketer). As the broadband population continues to explode, application developers (such as Microsoft and Intel) and consumer electronic companies (e.g., Sony and General Electric) are increasing their focus and development of broadband-centric applications and services to further enhance the end-consumers' productivity, efficiency, and/or "entertainment experience."

As a result, carriers and service providers are able to capitalize on new and incremental revenue enhancement opportunities to increase their average revenue per user. Figure 2 depicts the increasing value of the "true broadband" household and quantifies the some of the incremental revenues associated with new and emerging broadband applications and services.

Finally, innovations in optical equipment and infrastructure have resulted in significant cost reductions in the deployment of FTTx networks. Over the last few years, the cost of optical cable and connectivity has fallen between 20 and 40 percent. Continued innovations in optical couplers and splitters also have resulted in a drastic price decline. Development of low-cost lasers, converters, processors, and optical transceivers has significantly reduced opto-electronic equipment costs -- with a projected compound annual decrease of 12 to 13 percent in cost over the next three years as technology continues to mature, competition intensifies, and volumes increase (Source: KMI Research). In total, these combined innovations have resulted in a 40 to 60 percent decrease in FTTx network infrastructure costs -- with another 10 to 20 percent decrease expected in the next few years as opto-electronic equipment innovations and manufacturing efficiencies continue to improve.

FTTH deployment cost analysis

In any network deployment, there are three main cost drivers: active equipment (switches, routers, multiplexers, etc.), passive infrastructure (outside plant cable, closures, etc.), and labor and installation (trenching, plowing, terminating, etc.). In a passive optical network architecture modeled with an average construction cost of $5 per foot to trench or plow the cable into the ground, the active equipment will account for 38 percent of the network cost, the passive infrastructure will compose 8 percent, and the labor and installation 54 percent. (The buried infrastructure was chosen since a majority of new housing developments require below-grade infrastructure.)

While over 50 percent of the deployment cost is the labor required to install the network, an overwhelming majority of this installation cost is attributable to trenching or plowing the cable into the ground, which would be required regardless of whether the cable contains copper, coax, or optical fiber. As mentioned previously, the active equipment that converts the optical signal into traditional RJ-11, RJ-45, and coaxial cable services will also experience significant price declines as the opto-electronic technology continues to mature.

More importantly, in "greenfield" deployments and new housing developments, most if not all of the trenching cost can be avoided by installing the FTTH infrastructure into the trenches with water, gas, or electrical utilities. While this savings is universal to any medium deployed in a greenfield environment, the savings associated with installing fiber is two-fold in that the FTTH network installed will be future-proofed with capacity to meet bandwidth demands over the next 20 to 30 years -- negating the need to overbuild the network in 7 to10 years and re-incur the high cost of trenching to install an FTTH network when bandwidth demands and service requirements exceed the capacity of the installed copper/coax network.

For example, if an FTTH network is deployed throughout a new 1,000-home development today, the estimated total cost of deployment would be approximately $1,572 per home (assuming $0.50 per foot shared trenching cost to install the cable plant). By installing fiber in the development, the developer/carrier eliminates the future need to overbuild the network to increase capacity. To quantify the future savings, the table lists the net present value of the future investment associated with having to overbuild a copper or coax network in 7, 10, or 15 years.

If a copper/coax network was initially installed in the proposed development and then overbuilt after 10 years, the incremental investment required to simply trench in new cable infrastructure would be $1.85 million. Using a 14 percent discount rate, the net present value (NPV) of this future investment would be $499,801 or approximately $500 per home -- more than 30 percent of the initial deployment cost of the FTTH network. At 15 years, the NPV of the overbuild cost would still be more than 20 percent of the cost of initially deploying a FTTH network in the new housing development.

Conclusion

Over the last few years, PC penetration has continued to explode -- with a majority of U.S. homes owning at least one computer -- and processor speeds and capabilities have continued to increase exponentially -- with 2-GHz processors now shipping. At the same time, there have been many innovations and cost reductions that have drastically decreased the total deployment cost for FTTH networks. In addition, broadband applications and services are continuing to drive the demand for bandwidth while offering significant incremental revenue streams for carriers and service providers. As the convergence of computing and communications continues, fiber-based access networks such as FTTH will become the predominant broadband access technology in greenfield residential deployments and new housing developments -- creating a growing population of optical communities across the United States and around the world.

Shane Shaneman is manager of market development, access solutions, for Corning Cable Systems (Hickory, NC).