Price decline in 100GbE device shipments impacts vendors' profitability in 2017: LightCounting

Demanding cloud datacenter customers push suppliers to their limits

100GbE device shipments reached close to 2.9 million units in 2017 and is expected to surpass 5 million in 2018. In 2017, prices declined faster than anticipated, resulting in profitability concerns among vendors. Since buyers had placed duplicate orders, this eliminated some of the 100GbE demand, reports LightCounting. Much investment is needed to develop 400GbE products, and the market research firm does not anticipate that customers will purchase these products until ideal pricing is available.

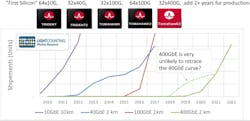

According to LightCounting, a correlation exists between the introduction of first switching silicon and early shipments of Ethernet optical transceivers with the 2 km reach often used in data centers(see "Data center appetite for 100GbE optical transceivers increasing: LightCounting").The firm predicts that 400GbE shipments will recall shipments of 100GbE for data center applications, which picked up in 2016 after the first 32x100G Broadcom Tomahawk switching silicon was sampled in 2014. The 32x400G Tomahawk3 ASIC was sampled in December 2017, and the first volume shipments of 400GbE will start in December 2019. LightCounting expects that the impact of this will be apparent by 2020.

The firm says it is not likely that the shipping of 40GbE starting two years after 64x10G switches were introduced will result in 400GbE shipping starting in 2018, two years after the release of 64x100G Tomahawk2, as 40GbE optics production was predominantly co-packaging of mature serial 10GbE technology elements. PAM4 optics and electronics will also be used for the first time, which presents another challenge for suppliers of optics, electronics, and test equipment as well.

Live demos of 400GbE optical transceivers were shown at OFC in March 2018, but since the first PAM4 chips still face function and availability hurdles, debugging PAM4 chips, switching silicon, and moving it to volume production may take a year, states LightCounting.

Originally 200GbE was expected to provide a 400GbE alternative, but that forecast has been reduced according to the "High-Speed Ethernet Optics" report. QSFP56 module support from equipment manufacturers has significantly declined in the past six months, and Google remains the only customer for 2x200GbE OSFPs, says to LightCounting.

The "High-Speed Ethernet Optics" report gives LightCounting's analyzation of increasing data traffic and the changing architecture of data centers on the market forecast for Ethernet optical transceivers, focusing on high-speed modules. The report uses historical data on Ethernet module shipments in combination with market analyst research to forecast sales of these products from 2018 to 2023. The report offers an extensive forecast for over 50 product categories, such as 10GbE, 25GbE, 40GbE, 50GbE, 100GbE, 200GbE, and 400GbE transceivers, sorted by reach and form factors. It also gives a summary of technical obstacles that high-speed transceiver suppliers face, including a review of suppliers' recent products and technologies.

For related articles, visit the Business Topic Center.

For more information on optical modules and suppliers, visit the Lightwave Buyer's Guide.