Cisco, Huawei, Juniper Networks, and Nokia are the clear leaders among edge/core router and switch vendors, according to the results of a survey IHS Markit recently conducted. That favorable perception has enabled the four vendors to control approximately 86% percent of the worldwide router and CES market by revenue, writes Michael Howard, senior research director and advisor, carrier networks, IHS Markit.

The 20 network operators who responded to the survey control 36% of worldwide telecom capex and a third of revenue, Howard reports. They named the four vendors leaders in all five of the top manufacturer selection criteria: price-to-performance ratio, product reliability, service and support, technology innovation and product roadmap. The gap between the quartet and their competition was large in every category except price-to-performance ratio, according to Howard.

Overall, Cisco came out on top of respondent edge/core router and CES manufacturer leadership scores. However, the four vendors traded positions within each category. For example, Nokia led in product reliability and service and support, followed by Cisco and Juniper. For technology innovation and product roadmap, Cisco and Nokia took the top positions. In price-to-performance ratio, Huawei came in at number one and ZTE at number two.

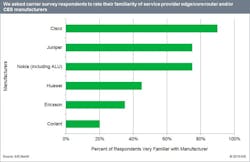

The big four also led in such other measures as unaided awareness, familiarity (or aided awareness; see figure above), and equipment installed and under evaluation. The companies also led when IHS Markit asked survey respondents to name leaders in next-generation routing technologies including 100 Gigabit Ethernet, virtual routers, and IP data center interconnect.

The 15-page 2016 IHS Markit switch and router vendor leadership survey features operator ratings of 11 vendors (Brocade, Cisco, Coriant, ECI, Ericsson, Fujitsu, Huawei, Juniper, NEC, Nokia [including Alcatel-Lucent], and ZTE) based on nine criteria.

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer's Guide.