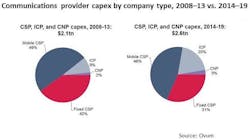

A new report from market research and analysis firm Ovum asserts that Internet content providers (ICPs) will become increasingly influential market shapers as traditional telcos reduce their capex budgets. ICP capex grew from $23 billion in 2008 to $46 billion in 2013, according to Ovum's "Communications Provider Capex Forecast Report: 2014–19: Internet content providers will drive growth in capital spending on network infrastructure." ICP capex will expand to well over $100 billion by 2019, the report adds.

Conversely, communications service provider (CSP) capex will remain relatively flat for the next several years, according to Ovum's analysis. CSP capex should over around the 2014 level of $340 billion because revenue growth will remain around 2% annually over the forecast period. ICPs will enjoy much stronger revenue growth; some – including Google – will spend a greater percentage of their revenues on capex than would a typical large CSP, Ovum believes.

"Ubiquitous broadband and user-friendly fixed and mobile access devices have changed the telecom industry dramatically. Enormous new value is being created by the new business models, apps, and service platforms now available to end users, many enabled by ICPs," notes report author and Ovum analyst Matt Walker.

If mainstream CSPs want to participate in this growth, they'll likely have to look toward partnerships, leverage startups and ecosystems for innovation, consider a broader range of suppliers, and look at M&A opportunities, Walker believes.

That said, the growth in ICP capex will not lead this niche to dominate overall spend, Ovum points out. For example, by 2019, fixed and mobile CSPs will still account for 29% and 44%, respectively, of total communications provider capex; ICPs will likely reach 24% of total capex, Ovum forecasts. Carrier-neutral providers (CNPs), mainly tower and data center specialist providers such as Crown Castle and Equinix, will account for another 3%, Ovum predicts (see figure above).

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer's Guide.