Colocation price variations significant says TeleGeography

Those with the necessary flexibility should shop for colocation space, based on a recent report from TeleGeography's Colocation Pricing Service. Baseline colocation prices – or prices per unit of power – differ widely by geography and often within the same metro market, the market research firm discovered.

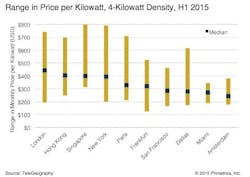

For example, the median monthly price per kilowatt for a cabinet with a power density of 4 kW is about $400, across key markets in Europe and Asia, the North American median price is 40% less. Prices can vary even more widely within each region, TeleGeography notes.

For example, those looking for a bargain in Europe should consider Amsterdam, Frankfurt, and Paris, where prices such as $245, $321, and $328 per kilowatt per month, respectively, can be found. Conversely, the median monthly price per kilowatt in London, at $444, is nearly double that in Amsterdam.

Similarly, the baseline price in Taipei is just $265 per kilowatt per month, well below the Asian median. And in North America, prices in Toronto, New York, and Phoenix are well above the regional median, at $450, $395, and $351 per month, respectively.

Even within a given market, shopping may pay off, particularly in such large markets as New York and London. Amounts as great as $550-$600 per kilowatt can separate the lowest and highest prices, TeleGeography notes. In comparison, colocation prices in Miami and Amsterdam differ by just $150 and $200, respectively.

Factors that contribute to price differences within markets include the diversity of customer niches served, the relative geographical positioning of data centers, and the degree to which colocation is commoditized, TeleGeography says.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer's Guide.

Stephen Hardy | Editorial Director and Associate Publisher

Stephen Hardy has covered fiber optics for more than 15 years, and communications and technology for more than 30 years. He is responsible for establishing and executing Lightwave's editorial strategy across its digital magazine, website, newsletters, research and other information products. He has won multiple awards for his writing.

Contact Stephen to discuss:

- Contributing editorial material to the Web site or digital magazine

- The direction of a digital magazine issue, staff-written article, or event

- Lightwave editorial attendance at industry events

- Arranging a visit to Lightwave's offices

- Coverage of announcements

- General questions of an editorial nature