The movie "Something's Gotta Give" chronicles the relationship between an older womanizer and the mother of one of his conquests. The movie's title and the relationship that forms its plot-bumpy and mismatched-might also describe the association of fiber and cable manufacturers with the telecommunications industry.

So far in 2004, fiber-optic-cable manufacturers have continued to feel the pressure of excess capacity and stiff competition. Prices are not dropping as rapidly as in the past two to three years, but they did not "bottom out" last year. There have been several reports of further decreases on large contracts this year.No discussion of prices can ignore the lingering effects of the telecom "bubble." The telecom collapse affected the optical-cable market in two ways that explain why the market value dropped 70% while the unit quantity decreased by "only" 43%. First, there was a shift in the mix of products. The higher-value, high-performance products experienced the steepest dropin demand. Specifically, demand for cable with nonzero-dispersion-shifted fiber (NZDSF) fell 67% from 2001 to 2003, while demand for cable with conventional singlemode fiber (CSMF) fell 42%. Second, cable prices dropped by 40-50% in two years, depending on the product family and geographic market. When the market collapsed, the fiber and cable manufacturers found themselves with excess capacity, which resulted in aggressive price competition.

Although improvements in fiber processing have lowered fiber costs over the years, other cable elements recently have had cost increases-at significant rates in some cases. Prices for some petroleum-based products, for example, have risen as much as 30% in the past 12 months, and that affects the plastic resins used for cable jackets and tubes, petroleum-based gels, and glass-reinforced-plastic strength members. Metal prices also have gone up this year, affecting the costs for armored cables. Energy and labor costs have risen. In the past two years, some cable manufacturers have offered free shipping, but rising fuel and transportation costs will make it difficult to continue this practice, especially with cable prices being squeezed downwards.

All of that puts the fiber and cable companies in a tight spot. In addition, telecom operators do not benefit enough from these price reductions to substantially increase their demand. A key reason is that the cabled fiber itself is a relatively small percentage of a new system's overall cost: In typical metropolitan environments with underground cable, the engineering, right-of-way, permitting, construction, splicing, and testing costs can represent more than 90% of the outside plant network's installed first costs, and that does not include the terminal electronics.

To analyze the magnitude of price decreases in the past few years, KMI looked at data on CSMF cable prices from the early 1980s. These data, adjusted for inflation and analyzed in terms of 2003 constant dollars, show the following trends:

- Compound annual growth rate (CAGR) of -16% from 1983 to 2003.

- CAGR of -11% from 1993 to '98.

- CAGR of -17% from 1998 to 2003.

- Two-year change of -42% from 2001 to '03.

- Year-on-year changes of -21%,-24%, and -24% in 2001, '02, and '03.

In other words, average prices for cabled CSMF have dropped consistently over a 20-year period, with rates frequently near -10% per year and sometimes as low as -20% per year. But the last two to three years showed a more severe decline than any equivalent period. Decreases have been more severe in some markets: One vendor says that North American cable prices have dropped by 50-60% since the third quarter of 2002.

Further, the decreases after 2001 were more severe than would have been forecast with a "learning curve" analysis. This concept, which has been used in different industries for decades, says that as the cumulative shipment quantities are doubled, the time (or cost) to manufacture the parts will drop by a previously observed percentage. In most industries, this percentage ranges from 5% to 25%. In other words, as the shipment quantities have doubled, the cost to produce the parts will be 75-95% of the original cost.

Assuming that margins and other business expenses are a uniform percentage of product prices, the learning curve concept proposed for manufacturing costs could be used to analyze price trends. Using data on unit-quantity shipments and actual prices for previous years, we can see which learning curve-or percentage-fits most closely with the actual prices.

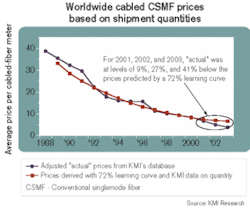

The history for CSMF cable prices shows the best fit with a 72% learning curve. The variance between the actual price and that predicted by the 72% learning curve ranges from 0% in 1999 to 41% in 2003. The average variance for the years from 1990 to 2003 is 11%, but the average variance for the years from 1990 to 2000 is only 7%.

The Figure shows the two price curves for 1988-2003. There are only two years in which the variance was more than 20%: 2002 and 2003. In each case, the actual price was more than 20% lower than the level predicted by the learning curve formula. There are three years in which the variance is between 10% and 20%: 1990, '91, and '96. In these cases, the actual price is higher than the learning curve price. Note that 1996 coincides with one of the fiber shortages.

During the shortage of 1999 and 2000, the actual and predicted prices were close. After that shortage ended in 2001, however, the actual prices dropped much more sharply than the predicted prices. That reflects the effects of excess capacity and competition for large contracts.

The differences between the actual and predicted price may have two explanations. First, we made the assumption that a learning curve for manufacturing costs could be applied to prices if margins and other business expenses are a uniform percentage of product prices. In this case, the cable manufacturers have indicated that they have severely squeezed margins, marketing, selling, research and development, and other expenses in response to market conditions. Another possible explanation is changes in manufacturing processes, product mix, or product designs within the family of CSMF cable products. And in this case, there's no evidence of shifts in product configuration that would lower costs significantly.

So the data suggests that the price trends of the past two to three years cannot continue and that a period of pricing stability should be expected. Yet even at current price levels, the situation for optical-cable manufacturers remains difficult, if not outright threatening. One industry participant says he doubts any U.S. company earns profits on fiber-optic cable and that price increases are needed or cable companies will exit the business.

Since 2001, Lucent Technologies sold its fiber and cable business. This year, Alcatel and Draka merged. Several smaller participants have closed factories or regional offices, exited geographic markets, or otherwise scaled back. Such measures can be expected to continue through 2005, because as we noted at the beginning, something's gotta give.

Richard Mack is vice president and general manager of KMI Research (Providence), a division of PennWell. He can be contacted via the company's Website, www.kmiresearch.com.