CLEC market weak but not dead yet

6 June 2003 Providence, RI Lightwave-- According to KMI Research's new report, U.S. CLECs: Market Developments and Fiberoptic Systems Deployment, the competitive local exchange carrier (CLEC) market in the United States has continued to show signs of growth, despite retrenchments in other areas of telecom services. According to KMI analyst Michael Arden, "CLECs have actually increased their access lines in both absolute numbers and in overall share."

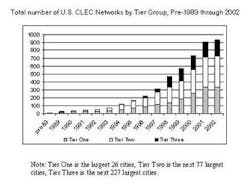

Nevertheless, CLECs in the U.S. have seen financial problems. Annual CLEC fiber deployment fell 80% from 2001 to 2002. More than one quarter of the CLECs profiled in KMI's report have gone into bankruptcy protection in the past 18 months, and another large portion of these companies have been merged into other entities. As a re-sult, total CLEC network growth is flattening. The figure below illustrates the cumulative number of CLEC networks in each group of cities (Tier One through Three), by year.

KMI forecasts a continued decline in annual fiber-kilometer deployments by CLECs, falling to a level under 450,000 fiber-km by 2007. This will provide a 3% compound annual growth rate for cumulative CLEC fiber-km from 2002 to 2007.

The future of CLEC fiber deployments appears to be in building extensions to existing networks. All Tier One cities have CLEC networks, and all but two of the Tier Two cities have at least one CLEC network. Among Tier Three cities, where the business proposition for CLECs has not been as strong, there is far less CLEC penetration -- 46% of Tier Three cities have no CLEC networks. Although many Tier Three cities provide an untapped market for CLEC networks, they do not necessarily have the busi-ness-center density and residential customer base that makes such a move realistic. As a result, many CLECs will focus on expanding the reach of their current networks through spurs and new building connections.

In 2001, 175 new CLEC networks were built in the U.S. Of these, 75 were in Tier One cities, 77 were in Tier Two cities, and 23 were in Tier Three cities. In 2002, only 25 new networks were built by CLECs, with 15 of them in Tier Two cities. Only four were in Tier One cities, with the remaining six in Tier Three cities.

CLEC fiber builds in Tier One and Tier Two cities are far more established than in Tier Three cities in terms of route-kilometer per population. A comparison of cumulative route-kilometers in CLEC networks and total CLEC networks per city reveals the extent of penetration of different Tier groups. In Tier One cities, there are 188.1 route-km per 100,000 inhabitants. This number in Tier Two cities is 98.11 route-km. Tier Three cities do not have anywhere near that level of CLEC route deployment in terms of population. CLECs in Tier Three cities have about 15.9 route-km of network per 100,000 people.

These economic realities will affect the business cases of CLECs in coming years and will affect new network deployments in smaller cities while fiber builds in larger cities will focus on extensions to reach new buildings rather than new metro networks, KMI believes.